Today banking is digital for most people, and financial institutions can be seen catching up on the preference.

While mobile apps have become common in the industry to enable banking on-the-go, the next trend we are seeing financial institutions catch up on is WhatsApp Banking.

WhatsApp has significantly enhanced the way conversations happen globally and with over 2 billion users across the globe, is a perfect channel for conversation banking.

Considering the scope and accessibility of WhatsApp, it is only practical to use the channel for deploying chatbots, sharing alerts and all-in-all creating a unique and reliable customer service experience. In this article, we will discuss how to leverage WhatsApp Banking in detail.

How is the Banking Sector Using WhatsApp?

With WhatsApp banking businesses can connect with thousands of agents and also interact and communicate with customers both manually as well as through automation.

Most banks use third-party business solution provider or WABAs like Interakt, to unleash the full potential of Whats

App Business API. Meta certified Interakt gives access to tools and protocols for the banking industry to facilitate their functioning across the customer journey, keeping in mind the security they need to offer.

5 Benefits of WhatsApp banking [2024]

Let’s take a look at some of the advantages of using WhatsApp for banking:

1. Reach and scalability

By using WhatsApp Business with an API solution provider, you can fully utilize the immense potential and scope of WhatsApp.

As your business grows and more people start preferring banking through WhatsApp, you can scale your messages and deliver to the customer demands. WhatsApp Business API for banking is hence a great channel for future-proofing your financial organizations’ customer communication and conversational banking services.

2. Enables easy onboarding

With most banks, onboarding can get pretty complex and frustrating for customers. WhatsApp can be used to digitize the whole process for first-time customers. Banks can share rich media and instructions to ease customers through the process.

3. Cost-effectiveness

WhatsApp, unlike calls, gives you the ability to instantly connect with customers, and share rich media content to promote your WhatsApp Business for banking services, all with minimal cost.

For instance, a chatbot employed to handle simple customer support queries eliminates the need for giant call centers and a room full of agents just to answer FAQs, thus saving a huge amount of time and money for your brand. WhatsApp also helps banks to improve ROI by utilizing the platform to improve the reach of their ad campaigns.

4. Automation capabilities

By automating your WhatsApp banking message templates, you can improve your response times and basically run promotions and marketing campaigns on autopilot. Auto-replies and automated flows also ensure that your business runs 24×7 without your team having to take on repetitive routine tasks.

5. Security

In the banking and financial sector, trust and security cannot be compromised in any way. WhatsApp’s end-to-end encrypted messaging allows the sharing of important documents, transaction information, personal details, private banking information etc. securely. This feature also ensures that you remain compliant with the local compliance measures and customers can communicate with you and trust your brand in such a secure platform.

Moreover, with the verified sender feature, your brand can display your legitimacy and credibility, which makes it easier for customers to trust your brand and interact with you without fear.

9 High Conversion Use cases of WhatsApp API for banking

WhatsApp for the finance financial sector has multifaceted use cases from adhering to customer queries to improving profits. Here are the use cases:

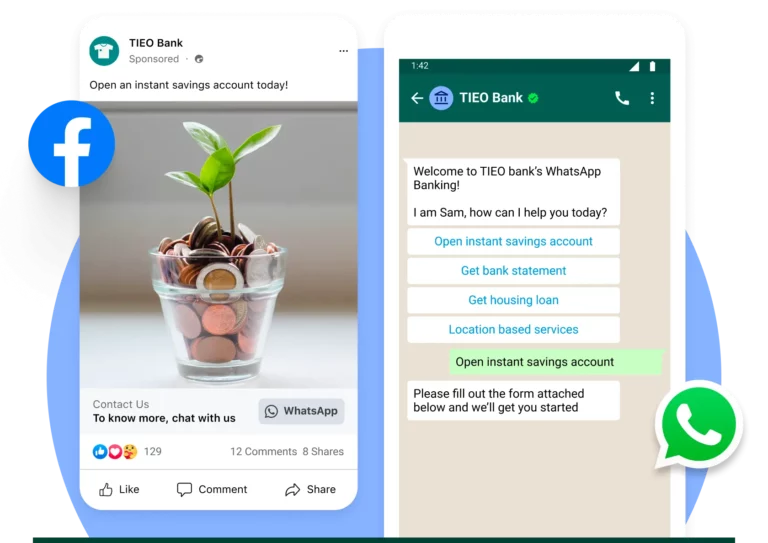

1. Lead generation process

Utilize WhatsApp’s click-to-WhatsApp feature for ads and opt-ins on websites:

WhatsApp offers a click-to-WhatsApp feature that allows you to seamlessly initiate engagement directly from ads or website opt-ins. This feature streamlines the process and creates a convenient and user-friendly entry point for potential customers to connect with your business. By making it easier for customers to reach out to you, you can increase engagement and improve the overall customer experience.

Collect valuable customer data upon opt-in, fostering trust through the familiar interface:

Upon opt-in, WhatsApp banking facilitates the collection of essential customer data. This streamlines the lead generation process and builds trust through the familiar and widely-used WhatsApp interface.

2. Lead following up and qualification

Seamlessly move from contact collection to qualification:

Use WhatsApp banking to effortlessly qualify leads and streamline your sales funnel. Personalize your approach with messaging, voice, and video calls, and share relevant content like demos and testimonials to build trust. Start converting more leads today!

Utilize WhatsApp automation for outreach, achieving a 90% open rate and 25% engagement:

Using WhatsApp automation for outreach campaigns is an effective way to reach leads, thanks to its high open rate and engagement. With read receipts and multimedia messages, businesses can refine their strategy to better resonate with their audience. By automating the process, businesses can save time and resources while still maintaining a personal touch.

3. Onboarding customers

Engage new customers with a WhatsApp assistant during onboarding:

A WhatsApp for the financial sector can be an assistant to improve onboarding for customers by providing personalized guidance. This leads to increased engagement and loyalty, aligning with customer communication preferences. Overall, it’s a worthwhile investment for a positive impact on customer experience and retention rates.

Provide personalized guidance for a smooth introduction to banking services:

The WhatsApp assistant provides personalized guidance to new customers exploring banking services. It offers customized recommendations and advice on account opening, loan applications, and financial management. Our goal is to make the introduction to banking services easy and stress-free for our customers.

4. Document upload

Simplify onboarding with WhatsApp for document upload and validation:

Streamline the onboarding process by allowing users to upload and validate documents directly through WhatsApp. The familiar interface reduces friction and enhances user experience.

Users feel at home with the interface, ensuring continuity even if the process is interrupted:

WhatsApp’s user-friendly interface and seamless document upload process make it a popular choice for individuals and businesses. Interruptions are easily picked up where left off without having to start over, providing peace of mind for users.

5. Account services & management

Implement WhatsApp automation for seamless account management:

Integrate WhatsApp to provide customers with efficient and seamless account management services. This includes balance checks, credit card status, due payments, and transaction history.

Facilitate requests such as balance checks, credit card status, due payments, and transaction history:

WhatsApp automation can revolutionize customer service for banks. They allow customers to manage their accounts with ease, from checking balances to updating information. Quick responses on WhatsApp to inquiries save time and improve satisfaction. This boosts efficiency, reduces costs, and enhances the customer experience.

6. Payments and transfers

Enable hassle-free fund transfers via WhatsApp banking:

Use WhatsApp banking for secure and effortless peer-to-peer and business fund transfers. This technology provides a convenient and familiar platform for digital payments, offering features such as bill payments, account balance checking, and AI-powered user experience. By adopting this technology, businesses and individuals can stay up-to-date with the latest trends in financial technology while enjoying the ease and security of digital payments.

Enhance convenience for paying bills and issuing transaction confirmations:

Enable bill payments and transaction confirmations through WhatsApp for faster and more convenient financial management. Customers can securely pay bills and receive confirmation without logging in or visiting physical offices, improving the overall customer experience.

7. Answering frequently asked questions

Implement a WhatsApp bot to efficiently handle common queries:

Use WhatsApp automation to efficiently address frequently asked questions. This frees up human agents for more complex tasks and improves customer satisfaction.

Free human agents for more complex tasks while resolving customer inquiries faster:

AI-powered tools can automate responses to common queries, optimizing customer service operations. This saves human agents time and resources, allowing them to focus on complex customer inquiries that require personalized attention and problem-solving skills. Streamlining customer service processes enhances the overall customer experience.

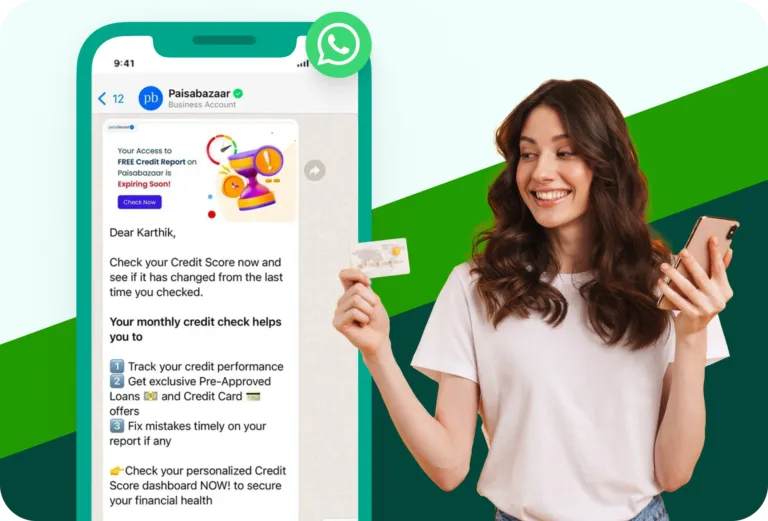

8. Send updates & reminders

Utilize WhatsApp’s daily user engagement for essential notifications:

WhatsApp is a powerful platform for keeping customers informed in real-time. It’s user-friendly and allows group messaging to reach a larger audience. Include essential information to keep customers up-to-date.

Share news about services, opportunities, and send reminders for payments or invoices:

Keep customers informed about new services, opportunities, and impending payment deadlines through targeted updates and reminders delivered via WhatsApp.

Check out these 12 Ready To Use WhatsApp Business Notification Templates for Bank to boost customer support and satisfaction.

9. Customer feedback

Leverage frequent WhatsApp usage for customer feedback requests:

Take advantage of the high frequency of WhatsApp usage among customers to solicit valuable feedback. This increases the likelihood of customers responding promptly to feedback requests or surveys.

Obtain valuable insights for continuous improvement of banking services:

The feedback obtained through WhatsApp provides valuable insights, contributing to the continuous improvement of banking services. It serves as a crucial tool for enhancing customer satisfaction.

What features of Interakt can you use for WhatsApp banking?

Interakt’s set of tools and features can help you utilize the WhatsApp Business API to provide quality service and enable more engaging and effective conversational banking through the platform. Here are some of the features of Interakt that can help your WhatsApp banking endeavor:

1. Code-less Chatbot builder

Interakt lets you build a chatGPT-powered AnswerBot, without having to know a single line of code. You can build chatbots, deploy them and optimize them with zero knowledge of coding and thus use it to enhance your customer experience with instant replies.

2. Conversation automation

Interakt offers exceptional automation capabilities that enable businesses to level up their conversational capabilities significantly. Conversational automation allows banks and financial organizations to engage customers with unique, human communication.

These conversations will be based on predefined conditions that you can set up according to different use cases, such as onboarding assistance, or a reply to an FAQ. This not only cuts costs as a cheap solution but also reduces the expense of hiring additional multiple users on WhatsApp to manually communicate with customers.

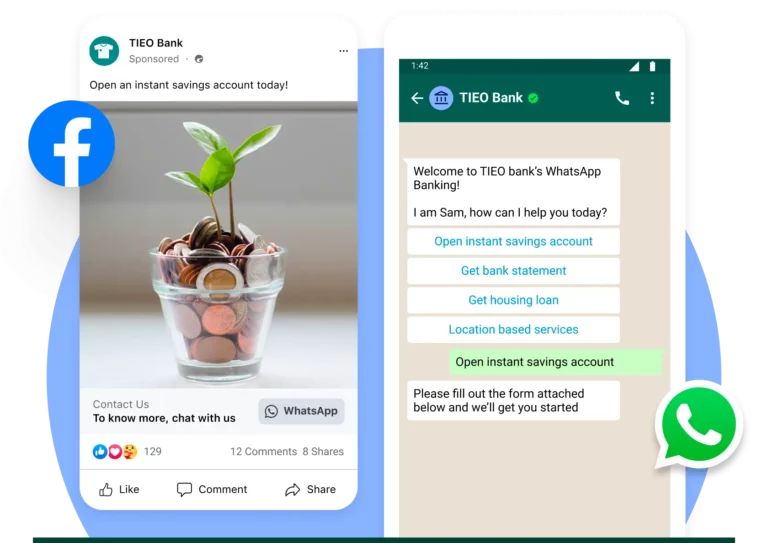

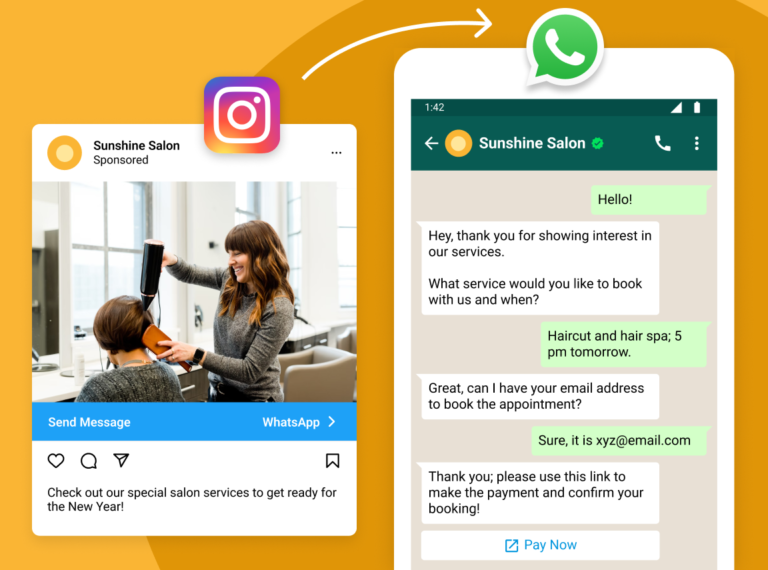

3. Click-to-WhatsApp ads

WhatsApp banking is convenient and customers won’t know this till they experience it. Interakt allows you to run Click-to-WhatsApp ads to invite customers into WhatsApp organically. You gain contacts automatically and once they reach out to you, you can engage with them and provide them an excellent conversational banking experience seamlessly.

4. One-time campaigns

The one-time campaign feature of Interakt allows banks and financial businesses to share targeted customized template messages to customers. You can also segment the audience list and send out these one-time campaigns to specific customers so as to drive engagement and revenue from your existing customers. By targeting your campaign better, you can improve your open rates and response rates, thus increasing the effectiveness of your efforts.

Conclusion

WhatsApp banking is the new best thing in conversational digital banking, offering easy, accessible support and service solutions to engage and inform customers in a timely manner. But without the WhatsApp Business API, there is only a limited scope in using WhatsApp for financial and banking services.

Interakt can help you utilize the WhatsApp Business API to its full potential and enable you to provide a personalized, efficient and reliable banking experience to your customers.